5.65.390 Common ownership.

This section is included in your selections.

As mentioned in WSSC 5.65.100, properties that are too small for residential or commercial improvements, commonly referred to as “unbuildable” or “outlots,” are generally exempt from assessments. However, an outlot that adjoins a regular lot and shares the same ownership is assessed, because the outlot, like the regular lot, receives a benefit from the availability of public water and/or sewer.

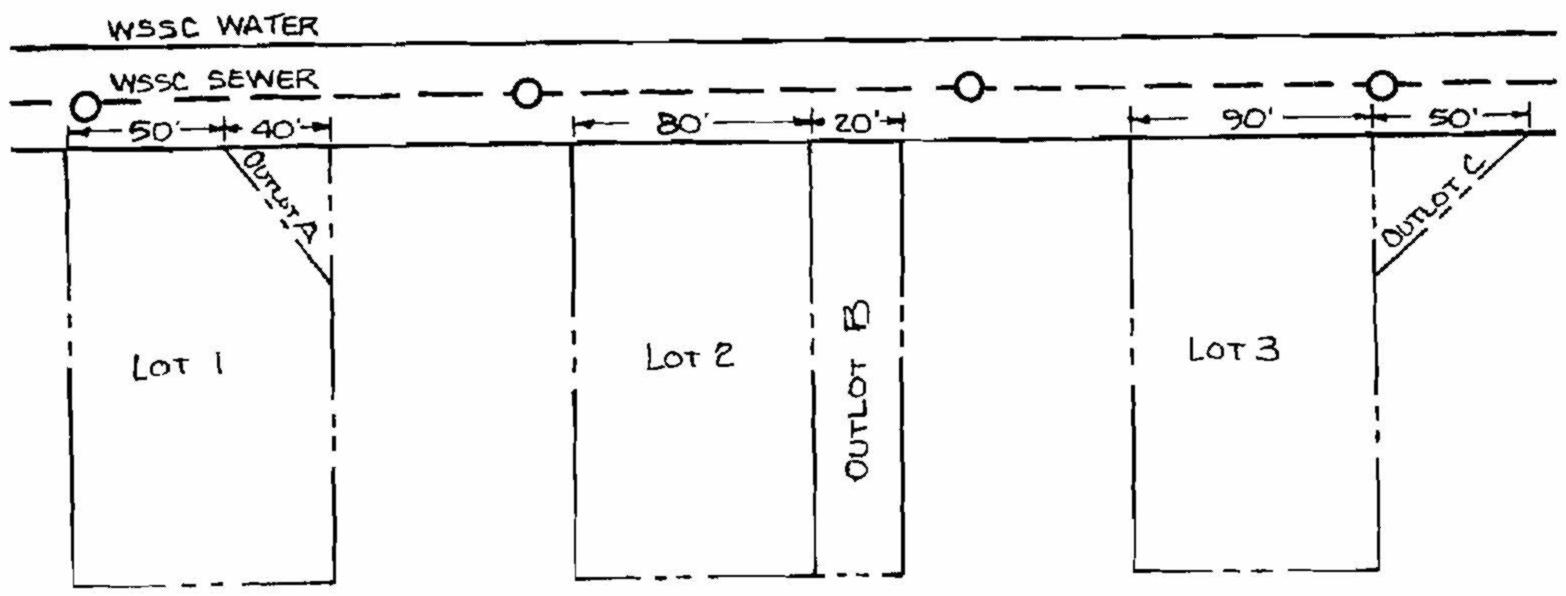

Example of Outlot with Common Ownership

Lot 1/Outlot A and Lot 2/Outlot B would both be assessed since the adjoining outlots are being used in conjunction with the properties’ yards. Lot 3/Outlot C would remain exempt since Lot 3 receives no additional benefit. (Property assessments manual § 10.2, dated October 1998)