5.65.450 Reclassification procedures.

Property classification changes are derived from county records, plumbing records or field inspections. When a property’s new classification warrants a change or reclassification of its FFBC, the rate and footage used to calculate the new FFBC, as well as the length or term of the new assessment, will be determined as follows:

(a) Rates will be based on the new classification and the rate(s) in effect the year during which the line(s) abutting the reclassified property were built.

(b) Footage. The footage will be determined by using the assessment methodology of the new classification, as described in Articles III through VIII of this chapter.

(c) Term. The new FFBC are levied for the balance of unpaid years of the original assessment. For example, if the original assessment was for 23 years of which 10 were at the small acreage classification and the property is reclassified to business, the business levy will run for the remaining 13 years.

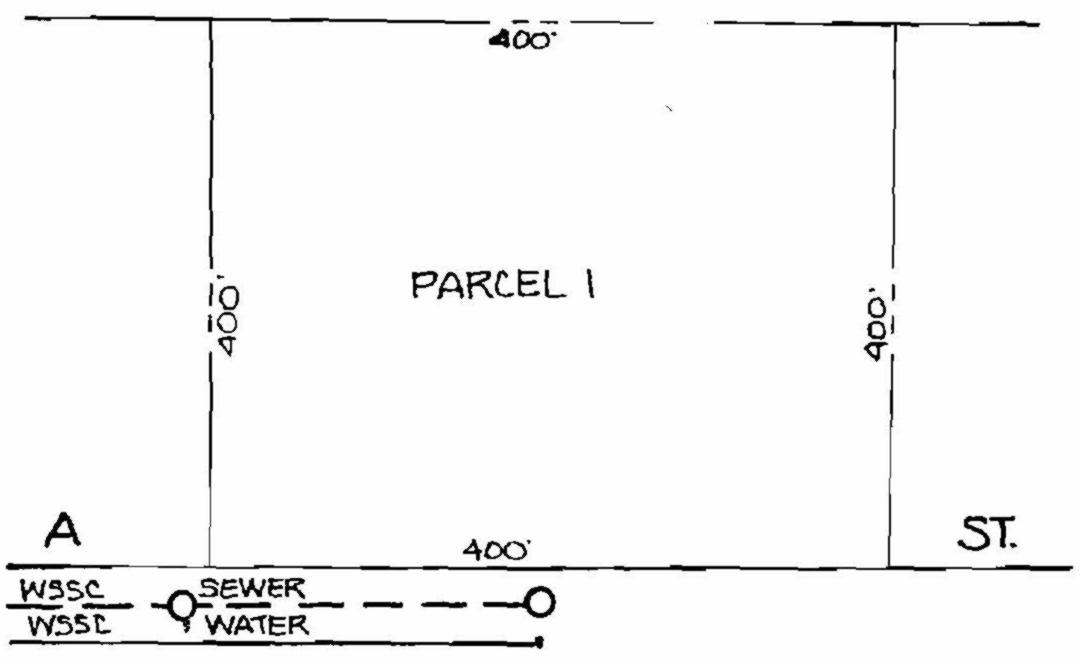

Example of a Reclassified Property

Parcel 1, originally classified as small acreage, was assessed for its pipe abutment of 200 feet beginning in 1990. The property was reclassified as single business in 1997. Therefore, the property was assessed for its full street frontage of 400 feet at the appropriate business rate. The “reclass” assessment would run for the 16 remaining years of the 23-year bond. (Property assessments manual § 11.2, dated October 1998)